Mary Meeker’s annual Internet Trends Report is essentially required reading for anyone who works in tech and advertising. In 355 slides, she analyzes relevant trends in internet adoption, advertising + commerce, media + entertainment, gaming, enterprise healthcare, China, India and startups.

In this post, we break down some of the key trends that advertisers need to know:

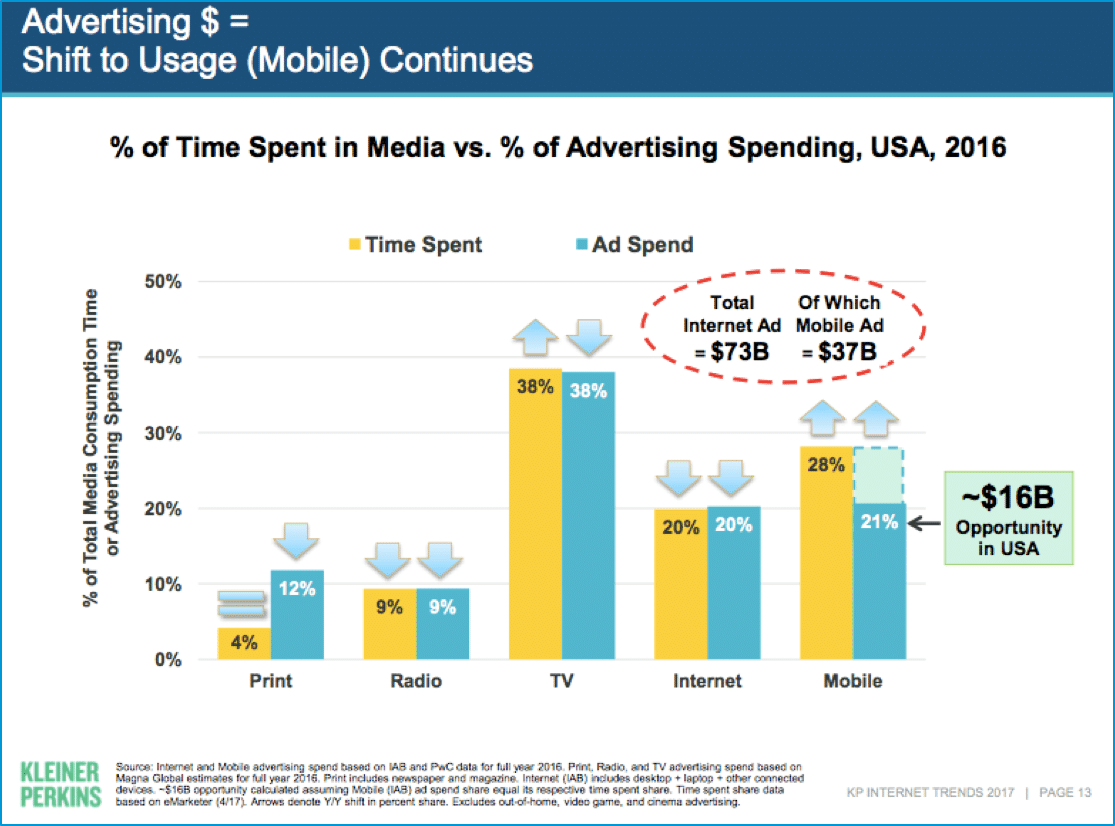

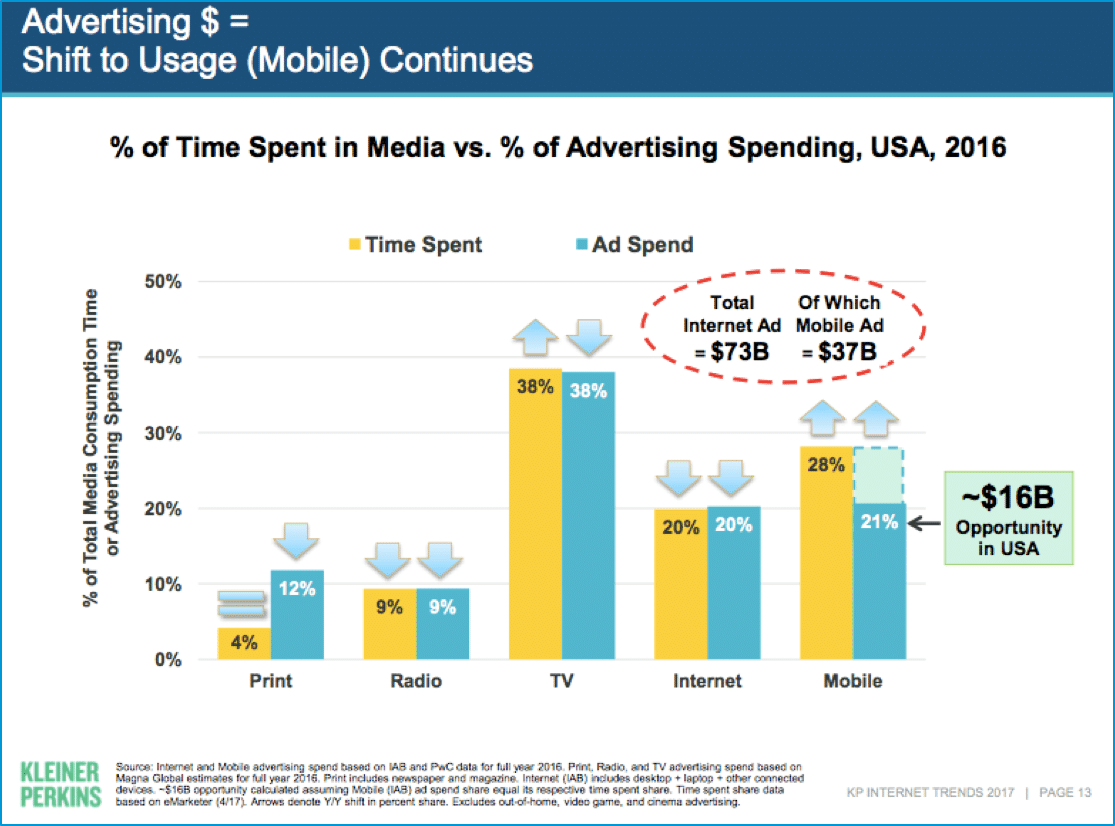

Meet consumers where they spend their time

The shift to mobile continues as consumers increasingly concentrate more of their media time in mobile at the expense of other channels. However, advertising dollars have not kept pace resulting in a $16 billion opportunity based on the gap between consumer time spent in mobile and advertising dollars spent in mobile. It’s critical for marketers who seek to build relationships with consumers to meet them where they are spending their time. In today’s advertising economy, consumer attention is the new currency.

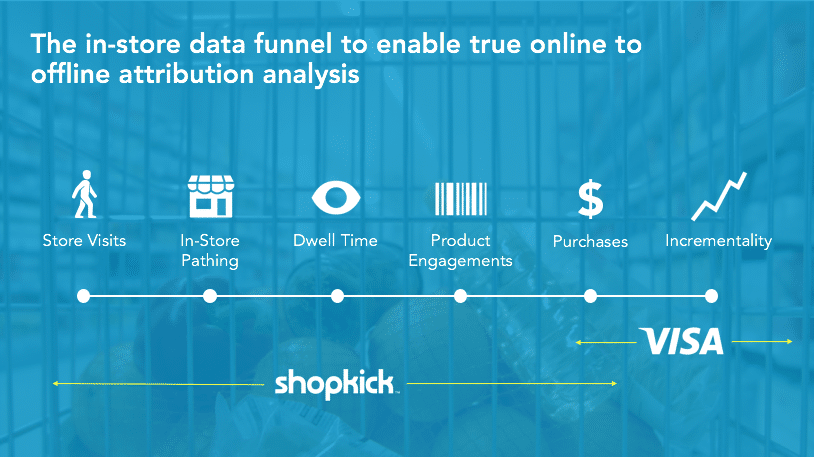

Challenges in cross-channel ad measurability

While advertisers rely on measurable engagement metrics, there are still widespread challenges in measuring ROI and offline metrics like conversion and revenue. Before even measuring sales, most marketers and platforms are still trying to figure out if and how their digital activities drove in-store visits. For example, Snap recently acquired PlaceIQ, and Google have Facebook are now attempting to track store visits and sales through POS data. In 2016, Deloitte reported that digital’s influence on in-store sales surpassed 50%, influencing 56% of all in-store retail sales. Yet understanding this influence on a shopper-level is still a challenge for most retailers. In fact, 67% of retail executives said their greatest obstacle in offering an omnichannel experience is tracking customer analytics across channels. See more on how Shopkick measures online to offline attribution here.

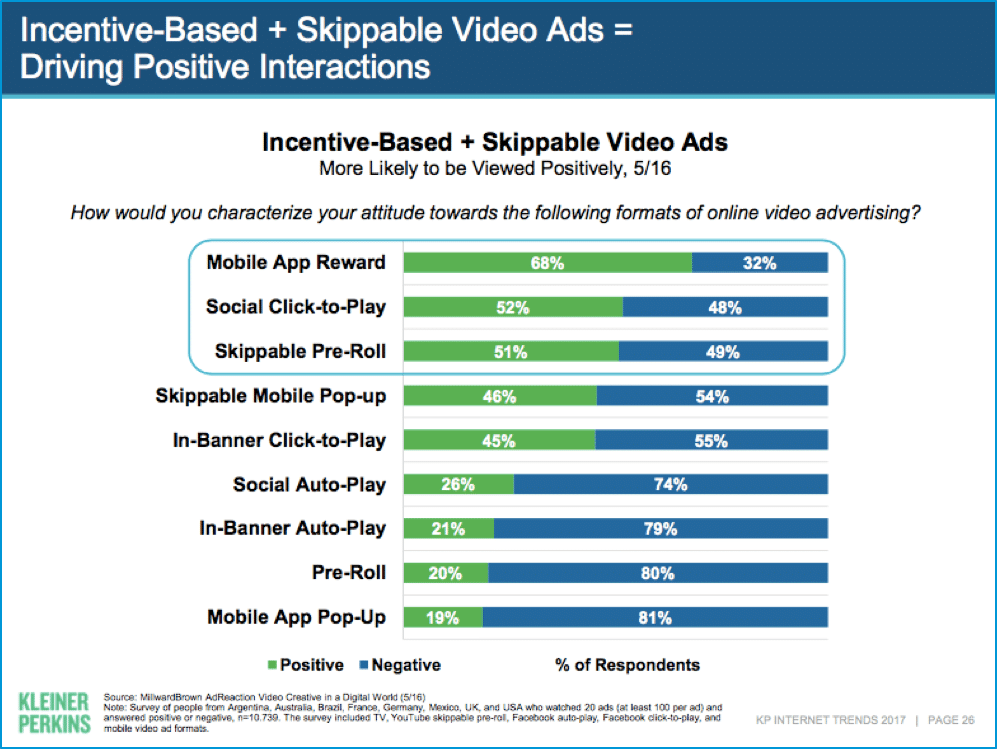

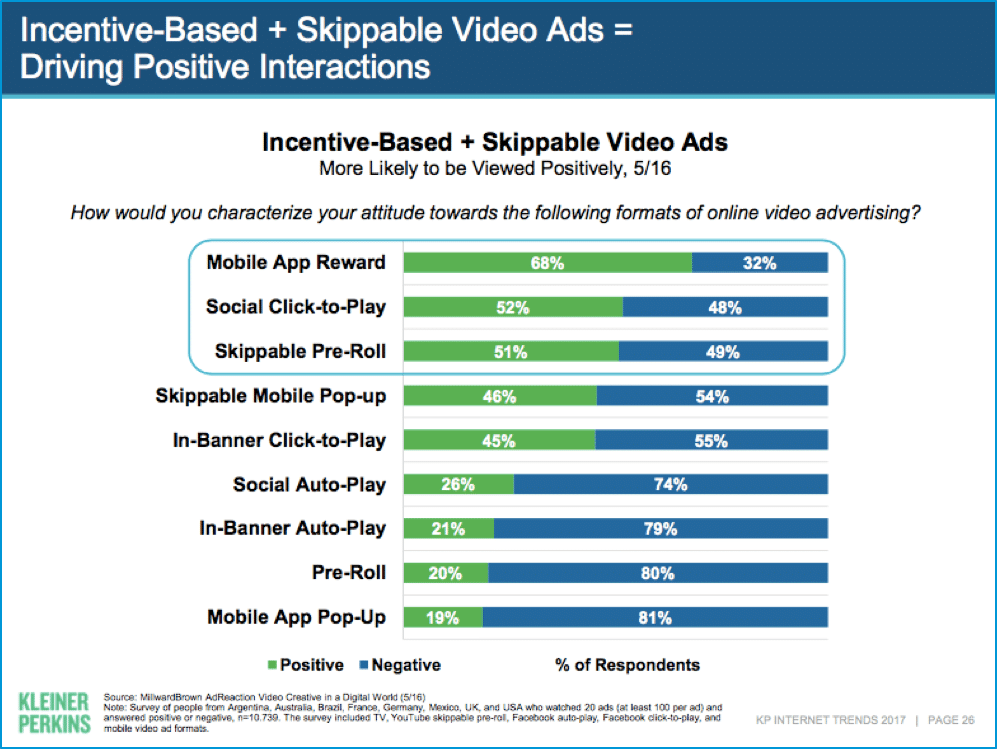

Understand the ads that consumers want

Consumers increasingly view non-native advertising formats as both interruptive and annoying, which is why ad blocking software penetration continues to grow. Already close to 20% of US consumers have it installed and that number is much higher in developing markets like China and India. However, there are ad formats that are viewed more positively, particularly incentive-based video ads tied to mobile app rewards, social click-to-play and skippable pre-roll. For example, 68% of consumers view mobile app reward video ads as positive vs just 19% for mobile app pop-up video ads. This has implications for viewability and engagement going forward, and incentive-based video will continue to grow with consumer favorability.

Shopkick has seen tremendous results with rewarding users for watching video on our platform. Our engagement rates are significantly higher than industry standards, with a 93% completion rate vs. 68% (IAB). Video is also a powerful driver of in-store activity, increasing both product engagements and purchases. See a case study from Barilla on the power of incentive-based video on driving in-store metrics here.

Incorporate gamification tactics to optimize loyalty and engagement

Mary Meeker examines best practice gaming mechanics like repetition, planning workflows, solving puzzles, completing projects, leveling up, and competition. Successful non-gaming companies have also incorporated these tactics into their products to optimize consumer learning and engagement.

Shopkick is a shopping rewards program, and like many other loyalty programs, we have incorporated conventional gaming tactics into our app to keep our users active, engaged and retained. As a result, users report feelings of great satisfaction and accomplishment after having earned rewards and accumulated kicks. Advertisers should incorporate these mechanics into marketing strategies on a campaign level or when selecting advertising partners. These tactics can be leveraged to keep consumer’s attention, keep them engaged, and keep them loyal.

To read the full Internet Trends Report, view here.