Background

A leading coffee brand approached Shopkick to increase awareness of its 2016 holiday seasonal flavors and drive sales of two packaged products in grocery and mass stores nationwide. To reach consumers in the planning phase, the brand wished to leverage video content to build consideration and increase brand equity. In-store, the goal was to drive engagement at the crowded coffee shelf and incentivize consumers to pick up the products. The team wanted to understand conversion and capture consumer insights throughout the purchase journey. Finally, the brand was looking to preserve margin by incentivizing traffic, engagement and sales through rewards and not coupons or discounts.

Shopkick Solution

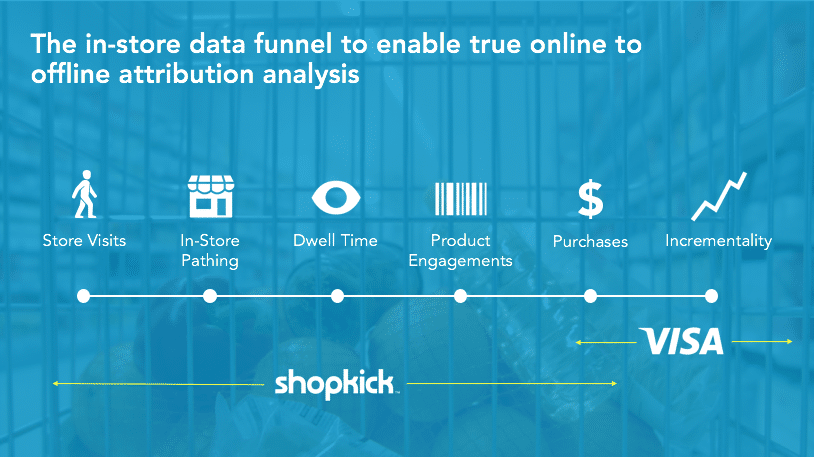

Shopkick first built pre-shop consideration with video and editorial content to drive awareness of product assortment. Shopkick then drove traffic, in-store product engagement, and purchase conversion by motivating engagement with ‘Kicks’, or rewards.

Results

Sales impact was measured by Nielsen Catalina Solutions. The overall campaign showed positive results across all key metrics including incremental dollar sales, buy rate, purchase frequency, and share shift.

-

- 66 million impressions

- 8% total incremental sales lift

- 42% of total incremental sales were from NEW buyers

- 66% of K-Cup sales were NEW buyers

- 1.07% total share shift