Today’s grocery shopping experience exists across two universes: the digital and the physical. Shoppers are increasingly turning to apps, e-commerce, and digital personal shopping for convenience. Amazon’s recent acquisition of Whole Foods for nearly $14b is a clear indicator that the battle for innovation in grocery is on. How can grocers continue to attract business in this ever-evolving space?

Why Shopkick Grocery?

As a shopping rewards app, Shopkick’s mission is to drive product engagement and in-store action—effectively re-energizing consumers around the modern shopping experience. For the last seven years, Shopkick has primarily served the electronics and consumer apparel industries, but 2017 marks a new venture into the grocery store vertical.

Grocery is a large, attractive market with $770B in total supermarket sales in the US, and we believe it’s one in which we can contribute. Adding a mobile digital layer to brick-and-mortar grocery stores is the next step in necessary innovation. With online options gaining traction, turnkey mobile solutions like Shopkick can help incentivize shoppers of all ages to continue visiting stores.

These incentives matter more than ever, especially in light of the perceived convenience of shopping online. After all, high-frequency essentials shopping can be time-consuming and cumbersome. According to a user survey, 70% of Shopkick users visit multiple grocery stores every week. This gels with 2016 FMI findings that show an average of 1.6 shopping trips per week. For many, planning the grocery trip starts long before they step foot in the actual store—from reviewing the pantry and fridge (85%) to scanning for deals and coupons (60%) to planning meals (40%) and checking with other household members (50%).

According to Nielsen research, the most common forms of in-store digital engagement are online or mobile coupons and mobile shopping lists. However, most brands would prefer to drive users to shelves without the use of costly coupons, which can crunch profit margins and dilute their brand. Shopkick empowers these brands by offering new and innovative ways of incentivizing sales—without requiring coupons or other traditional methods.

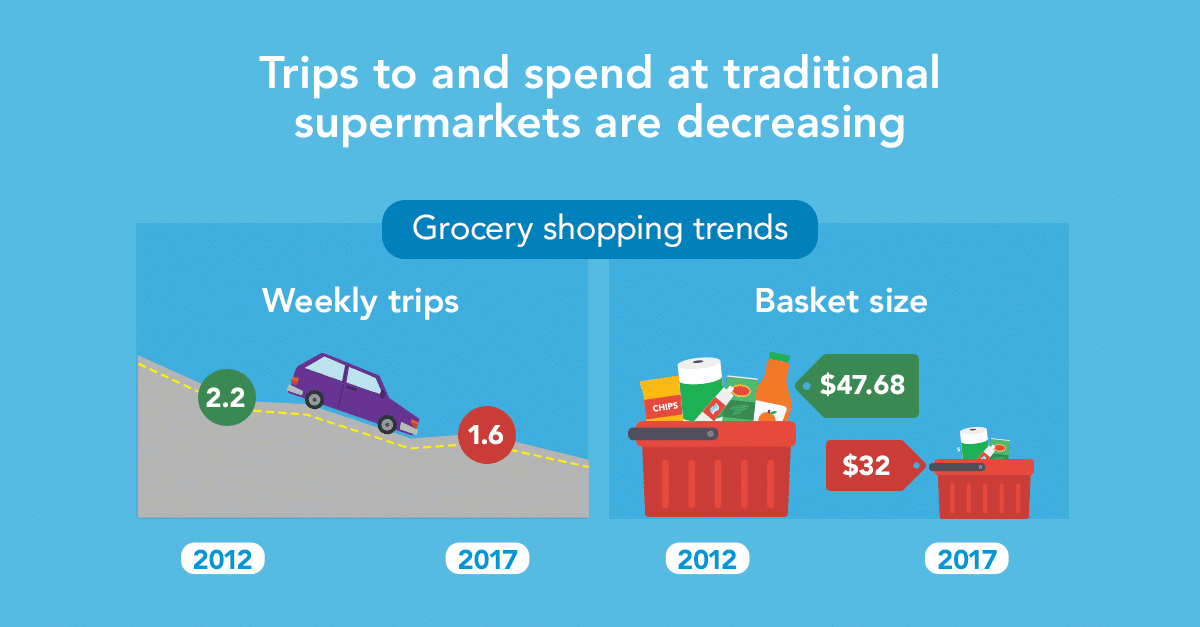

We’re pleased to share that so far, it’s working. We’ve spent the last year in beta testing, and we’re encouraged by what we see: Shopkick Grocery users spend nearly twice what the average American spends on groceries ($59 versus $32 a visit). They also go shopping more often (an average of 2.2 versus 1.6 times weekly). Product engagement is also boosted—with users engaging 33% more with what they see on the shelf than those who don’t use Shopkick.

The reason is simple: the game of earning rewards is fun. In the context of grocery shopping, one moment of joy goes a long way, and Shopkick provides these moments at home, in the aisle, at the register, and beyond. Retailers like Whole Foods have gotten the memo, too, with efforts focused on making grocery shopping more pleasant and aesthetically pleasing overall. It’s all part of the transformation from something that feels like a chore to something one actively chooses to do—and ensuring the longevity of a tried-and-true American pastime: shopping at the grocery store.

To learn more about Shopkick Grocery, visit https://www.shopkick.com/grocery-partners or contact us.