Kristy Stromberg, Chief Marketing Officer

Silicon Valley sets the pulse for trends in the tech industry. From fashion to funding, leaders in this tech hub determine what’s fleeting and what’s here to stay.

Lately, it seems to be the consensus that customer research is out of style. Tech teams are claiming that the best approach to customer research, it turns out, is no approach at all. Many tech companies are choosing to skip customer research entirely, claiming that:

“It’s not worth asking because consumers don’t know what they want.”

“It’s up to us to innovate — Steve Jobs didn’t need research.”

“If Henry Ford had asked people what they wanted, they would have said a faster horse.”

Startup product and marketing directors are often disinterested or unwilling to invest in customer research outside of basic analytics before rolling out a new product or marketing tactic. It’s time that we stop and ask ourselves whether it’s time to rethink the importance of customer research, and whether skipping it altogether is a big mistake.

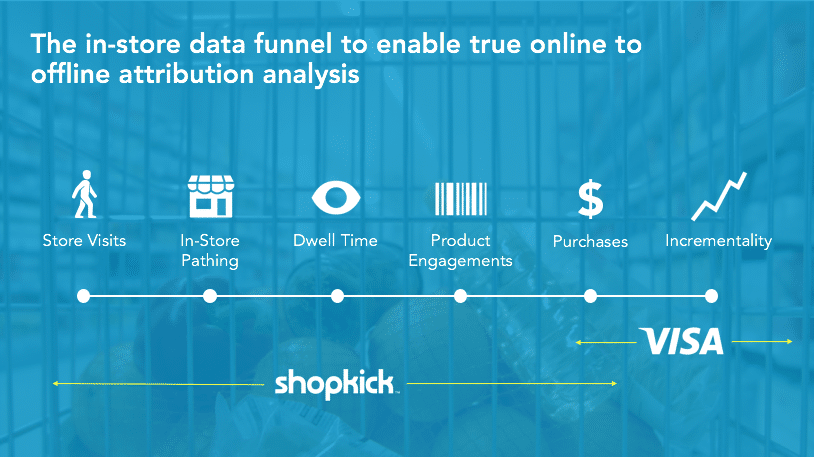

Big data solutions have allowed tech companies to concentrate on measurable behavioral data: how consumers interact with a product, how they might stumble upon a webpage or app store page, how much time they spend interacting with the page content, etc. While there is no doubt that this information is relevant, behavioral data paints an incomplete picture. It fails to help us comprehend the “why” behind these numbers. To lead with innovation and influence customer behavior, qualitative research is a must.

At Shopkick, we offer users the opportunity to earn free gift cards for the shopping behaviors they already do. While the practical, monetary advantage behind Shopkick is clear, we never predicted the emotional benefit that our app would provide to users. When sitting down and speaking with Shopkick users one-on-one, it became apparent that Shopkick means much more than simply racking up points and receiving free gift cards. For many users, Shopkick is a way to interact with family, some turning the app into a scavenger hunt for their children. Others use Shopkick as a competition game, and see shopkicking as a social event to spend time with friends and family.

Speaking with our users one-on-one brought to light an emotional benefit that we wouldn’t have discovered without qualitative research. In fact, “Bringing moments of joy to everyday shopping,” is now our official brand promise, guiding many aspects of our marketing and product efforts. Shopkick encourages users to spend more time with their friends and families. We help users treat themselves, and to treat the ones they care about.

Customer research is an essential tool for understanding how your brand or product is making a meaningful impact on users’ everyday lives. When it comes to gaining relevant consumer insights and influencing customer behavior, getting to know your audience will never go out of style.